- Component I (One) - Understanding the Products

- Processes & Requirements

- System, Sales & Training

- Motivational & Sales Tips

- Claims and Mild Shock Payment

- Key Reminders for CoMs

- What is Index-Based Livestock Insurance (IBLI)?

- Hospicash & Last Expense Cover Product

- What is Takaful?

- What is Sharia Compliance?

- What makes Takaful Sharia compliant?

- How does Takaful differ from insurance?

- Must surplus be paid to participants in a takaful contract?

- What is ReTakaful?

- How does index-based livestock Takaful (IBLT) work in practice?

- What Takaful model does the DRIVE product adopt?

- What is the status of the Takaful market in Somalia?

- Is the local Takaful market holding the risk under DRIVE?

- How is Sharia compliance established in Takaful?

- Why is there a need for a Supreme Sharia Supervisory Board (SSSB) or National Sharia Council?

Component I (One) - Understanding the Products

Q1: What are the products being offered to Pastoralists for the OND 2025 season under DRIVE project?

The products include.

- IBLI: Index-Based Livestock Insurance

- Mild Shock Saving Bonus

- Linda Mfugaji (Hospital Cash and Life (Pilot only for Isiolo, Samburu, Kitui, and Kilifi counties)

Q2: What is Index-Based Livestock Insurance (IBLI)?

IBLI is an insurance product that protects pastoralists against drought-related forage loss. It uses satellite vegetation data (Normalised Difference Vegetation Index – NDVI) to determine payouts. If forage falls below a set trigger, pastoralists receive cash compensation to buy feed and fodder to keep their animals alive.

Q3: What is the Mild Shock Saving Bonus?

The Mild Shock Saving Bonus is a government-backed saving bonus that helps pastoralists build resilience during mild droughts. The savings are released to pastoralists at the end of the season during mild drought to enable pastoralists manage their livestock when drought levels does not reach where insurance payouts are made.

- If a pastoralist buys IBLI for at least 3 TLUs (3 cows or 30 goats / sheep, or 2 camels) and then saves KSH 3,000, the government adds KSH 7,000.

- Total savings = KSH 10,000, locked in a savings account opened by pastoralists.

- Money is released if:

- A drought trigger of 33% occurs, OR

- After 12 months (July 2026).

- Pastoralists can also borrow against these savings from partner banks.

- A maximum of 50% of the total savings is released after end of OND 2025 season (released in Jan 2026) if a trigger is achieved.

Q4: What is Linda Mfugaji (Hospital Cash & Life Cover)?

This is a pilot product only available in Isiolo, Samburu, Kitui, and Kilifi counties. It supports families against loss of livelihoods during hospitalisation and death:

- Can be taken as individual or family cover (spouse + up to 5 children).

- Premiums: KSH 676 (individual) or KSH 2,028 (family) per year. For additional spouse KSH 475 and additional child KSH 203

- Payment of KSH 7,000 to policyholder per hospitalization of insured family member (after 2 nights or more in any hospital registered under the MoH), 4 times per member per insured year.

- KSH 25,000 in case of death of an insured family member

Processes & Requirements

Q1: Who qualifies for IBLI and Mild Shock?

- To qualify for IBLI, pastoralists must:

- Belong to a pastoral group in DRIVE counties.

- Register, provide ID and basic details, and pay premiums for the number of TLUs they want to insure before close of IBLI sales window (1st October 2025)

- To qualify for Mild Shock, pastoralists must:

- Buy IBLI for a minimum of 3 TLUs by 1st October 2025, and

- Save KSH 3,000 before 31st December 2025.

Q2: How are payouts made?

- IBLI: Based on NDVI triggers (25% severe drought, payouts in Feb for OND season and Aug for MAM season).

- Mild Shock: 50% of savings released mid-Jan (OND season trigger of 33% mild drought) and the rest by July (MAM season trigger). If no drought, the full KSH 10,000 is released in July 2026.

- Linda Mfugaji (Hospital Cash & Life): Direct cash to insured/policyholder or family by the partner underwriter (Britam) in the event of a claim.

Q3: What government and partners support is available?

- Premium subsidy: up to 30 TLUs (increased from maximum 5 TLUs), with subsidy reducing as TLUs increase (70% for the first 5 TLUs for everyone down to 45% for 25–30 TLUs).

TLUs Subsidy Bands Table

| Band (TLUs) | Subsidy % (GoK) | Pastoralist Share |

| First 5 TLUs | 70% | 30% |

| Above 5 –10 TLUs | 65% | 35% |

| Above 10 – 15 TLUs | 60% | 40% |

| Above 15 – 20 TLUs | 55% | 45% |

| Above 20 – 25 TLUs | 50% | 50% |

| Above 25 – 30 TLUs | 45% | 55% |

| Over 30 TLUs | 0% | 100% |

- Mild Shock Savings Bonus: KSH 7,000 from GoK for those meeting Mild Shock requirements: minimum 3 TLU IBLI purchase by 1st October 2025 and savings of KSH 3,000 by 31st December 2025.

- Linda Mfugaji (Hospital Cash & Life): for the four (4) pilot counties, any policy holder who has ever purchased an IBLI policy and is willing to purchase a new policy during this season will be allocated a free individual member Linda Mfugaji cover from DRIVE .

- If renewing IBLI, after a free cover for the member, the member can top up and pay for a family cover by paying the balance (KSH 1,352 for family cover of 5 children and spouse)

- The offer is only available to those that will have purchased IBLI cover before 1st October 2025 and must be a renewal (must have bought an IBLI cover earlier – expired or ongoing policy)

- For first time IBLI cover buyers, they will pay 100% of the Linda Mfugaji premiums.

Linda Mfugaji is only available in four pilot counties of Isiolo, Samburu, Kitui and Kilifi.

System, Sales & Training

Q1: How do CoMs access the system?

- Only those who completed training (55% pass) can log in.

- The DRIVE APK app must be installed on their smart phones.

- Sales start immediately after system training.

Q2: What if pastoralists face registration or payment issues?

- Pastoralists can now view their payment status details including bonuses and claims through USSD *800*8#.

- Reporting of any non-payment issues can be done for free through the same USSD *800*8#.

Q3: What is the are the timing for each product?

- IBLI: Sales close on 1st October 2025

- Mild Shock Saving Bonus: Payment for KSH 3,000 close on 31st December 2025 (if you purchase IBLI for 3 TLUs and above).

- Linda Mfugaji (Hospital Cash & Life): Sales continue throughout the season for only those with active IBLI cover.

Q3: Will the system be locked after close IBLI sales?

No – the system will only lock IBLI sales but allow Mild Shock and Linda Mfugaji to continue for those that will have purchased IBLI covers for 3 TLUs and above.

Motivational & Sales Tips

Q2: What is the big opportunity for CoMs?

- Over 238,000 pastoralists are already covered, and they are ALL eligible for both Mild Shock and premium subsidy (including MAM 2025 policy holders).

- The government is committed with subsidies and bonuses – making it easier to sell.

- CoMs are not just insurance sellers but also financial inclusion agents – earning from insurance, savings, and market linkages.

- Enhanced Commissions for Community Mobilisers: 50% of the 8% (4%) commission paid from total IBLI premium (pastoralists premium + government subsidy) + 4% of the Government Mild Shock Saving Bonus of KSh 7,000 (KSh 280 mobilisation fee per pastoralists who pays KSH 3,000) + 8% of Linda Mfugaji (Hospital Cash + Life Cover) premiums.

- If a pastoralist who was last registered under a Community Mobiliser renews and pays for IBLI whether through USSD or through a Community Mobiliser, the commission will be paid to the Mobiliser who last registers them.

Q1: How can I earn more commission?

- Sell both IBLI + Mild Shock + Hospital Cash & Life together. Bundling gives pastoralists more value and increases your commissions.

- Target large groups and cooperatives – bulk policies mean higher sales and higher earnings.

- Link pastoralists to banks: You earn when savings and credit bundling happen.

Claims and Mild Shock Payment

Q1: What happens if the pastoralists annual policies do not make any payouts in two seasons?

- A profit sharing / profit commission mechanism is in place to give some money back in the event of little or no claims in the entire country. This will be considered after the end of the policy year. .

- The first targeted payout is for the expired OND 2024 annual policies that did not receive any payouts subject to approval by the risk carriers.

Q2: What happens for pastoralists who save KSH 3,000 and there is no mild drought trigger of 33%?

- The pastoralists will receive the total funds of KES 10,000 back at the end of the season in July 2025

Q3: What happens for pastoralists who saves less than KSH 3,000 by 31st December 2025?

- The pastoralists will receive their savings back without any Government Mild Shock Saving Bonus. The pastoralists savings will be deposited in their bank account or refunded through registered MPESA number.

Q4: Must pastoralists pay for IBLI, Mild Shock Saving and Linda Mfugaji by 1st October 2025?

- The pastoralists only need to have paid premium for IBLI covering 3 TLUs and above before close of IBLI sales on 1st October 2025 to qualify for Mild Shock Saving Bonus

- Mild Shock saving of KSH 3,000 can be paid in small amounts but not later than 31st December 2025 but only if pastoralists who were able to insure 3 TLUs and above before IBLI sales close on 1st October 2025.

- Linda Mfugaji is also only available to those with an active IBLI policy in the system as at for OND 2025.

Q4: When will the various payouts be made?

- IBLI Payouts:

- OND season –Feb – Max 43% of sum insured,

- MAM season – Aug – Max 57% of sum insured.

- Mild Shock Savings Bonus Release:

- OND season – mid Jan if 33% trigger is achieved – 50% of Mild Shock Savings

- MAM Season – July whether it Triggers or not.

- If OND season was paid – release remaining 50%.

- If OND season was not paid – release 100%

- If a pastoralist has borrowed against the savings, the bank will receive release instructions from ZEP-RE but will execute the release based on agreement between bank and pastoralists.

- Linda Mfugaji:

When a policy holder and insured member is hospitalised for more than 2 days or if an insured person dies

Key Reminders for CoMs

- Always explain “3 TLUs + KSH 3,000 savings = KSH 10,000 secured”.

- All pastoralists (new policies and existing policy holders – even those that were paid enrolment and ongoing saving bonuses) are all eligible

- Stress that savings are safe in the bank and can be used as collateral / security to borrow if the financial institution has a loan product.

- Highlight that IBLI ensures livestock survival in drought, while Mild Shock provides relief in mild drought, and Hospital Cash & Life protects families livelihoods.

- Motivate pastoralists with real stories of payouts and resilience.

- A community mobiliser will earn from three areas: IBLI commission 4% of total premium, Mild Shock Bonus 4% of total government contribution of KES 7,000 (KES 280 per every pastoralist who saves KES 3,000) and Linda Mfugaji 8% of total premium.

- Keep learning—new product updates will continue (profit commission, Sharia-compliant covers, credit bundling).

What is Index-Based Livestock Insurance (IBLI)?

- Always explain “3 TLUs + KSH 3,000 savings = KSH 10,000 secured”.

- All pastoralists (new policies and existing policy holders – even those that were paid enrolment and ongoing saving bonuses) are all eligible

- Stress that savings are safe in the bank and can be used as collateral / security to borrow if the financial institution has a loan product.

- Highlight that IBLI ensures livestock survival in drought, while Mild Shock provides relief in mild drought, and Hospital Cash & Life protects families livelihoods.

- Motivate pastoralists with real stories of payouts and resilience.

- A community mobiliser will earn from three areas: IBLI commission 4% of total premium, Mild Shock Bonus 4% of total government contribution of KES 7,000 (KES 280 per every pastoralist who saves KES 3,000) and Linda Mfugaji 8% of total premium.

- Keep learning—new product updates will continue (profit commission, Sharia-compliant covers, credit bundling).

Hospicash & Last Expense Cover Product

- What is Hospicash (Hospital Cash) insurance?

Imagine you have to stay in the hospital for a few days due to an illness or injury. While you are recovering, you still have expenses—like food, transport, or even loss of income if you can’t work. HospiCash helps you by giving you a fixed amount of money for when you’re in the hospital for more than two nights. This cash can be used however you want, whether it’s for covering small costs, paying rent, or buying medicine.

- What is the Last Expense cover?

The Last Expense cover is a financial safety net that helps your loved ones manage the costs of your funeral and burial if you pass away, whether it’s due to an illness, an accident or natural causes. It ensures your family doesn’t have to worry about these expenses during a difficult time.

- Who can enroll in the Hospicash and Last Expense cover?

- Pastoralists and their spouses aged between 18 and 74 years old.

- Children are from 38 weeks old to 20 years. Children aged 20 to 24 years may be covered if they are enrolled as students and provide proof of schooling.

- What benefits does this insurance offer?

- HospiCash gives you a fixed benefit of KSh. 7,000 if you’re hospitalized for at least two nights, and you can claim this benefit up to four times a year per person.

- Last Expense Cover provides KSh. 25,000 to help with funeral expenses in case of death of any of the covered family members.

- How much does the insurance cover cost?

- For one person: KSh. 676 per year (if renewing the policy, one if entitled to a free member cover. They can top up for family cover by paying the difference (KSh 1,352)

- For a family (covering you, your spouse, and up to 5 children): KSh. 2,028 per year.

- To add an extra spouse: KSh. 475 per year.

- To add an extra child: KSh. 203 per year

- What is a waiting period?

A waiting period is the time you have to wait after buying insurance before you can make a claim. For example, if there’s a 30-day waiting period, you can only claim for events that happen after those 30 days. It helps prevent people from getting insurance only after they know they need it.

- What are the waiting periods before benefits can be utilized?

- 1 month for illnesses and natural death.

- No waiting period for accidents, you’re covered immediately.

- 1 month for conditions that existed before joining or ongoing illnesses (chronic diseases).

- 10 months for hospital stays related to pregnancy and childbirth.

- How do I sign up for this insurance cover?

- Register for the DRIVE IBLI product first.

- Select a plan for yourself or your family.

- Share the details of your spouse and children, if needed.

- Make payment easily through your DRIVE package.

- Enjoy the cover for the next 12 months.

- What are the main advantages of this insurance cover?

- Provides financial assistance for hospital stays or in case of a loved one’s passing.

- Offers peace of mind by covering unexpected expenses.

- Allows you to use Hospicash payouts flexibly for any personal needs.

- Is there a specific hospital network I must use?

No, you can go to any hospital accredited by the Ministry of Health. However, to make a claim, the hospital stay must be at least two nights.

- What happens if a dependent reaches the maximum age during the policy term?

If a dependent turns 20 years old (or 24 years old for students), they will no longer qualify for coverage when it’s time to renew, unless they meet the requirements for student coverage which is proof of schooling.

- What documents are needed to make a claim?

- For HospiCash: A claim form, a copy of your ID, the hospital invoice and receipt, and the discharge summary from the treating doctor or hospital.

- For Life Cover: A claim form, the deceased’s ID or birth certificate, a burial permit or death certificate, the beneficiary’s ID, and a police report for accidental deaths.

- How do I make a claim?

To make a claim, text “Hi” on WhatsApp to 0705100100 and select the option to make a claim. OR

Dial USSD code *800*8# to initiate claim process.

- Can I claim multiple benefits at the same time?

Yes, if you meet the criteria for both Hospicash and Last Expense benefits, you can claim both.

- Is there any benefit if hospitalization is less than two nights?

No, the Hospicash benefit requires a minimum of two consecutive nights of hospitalization to be eligible for the payout.

- Is there a limit to how many times I can claim the Hospicash benefit?

Yes, the Hospicash benefit can be claimed up to four times per person covered per policy period (per year) for hospital admissions lasting more than two consecutive nights.

- How long does it take to process a claim?

Claims are typically processed within 72 hours after all required documents have been submitted and verified.

- How is the claim benefit paid out?

The claim benefit is typically paid out via bank transfer or mobile money, depending on your preference.

- Can I cover extended family members like parents or siblings?

The standard policy is designed for immediate family members (spouse and children). Coverage for extended family members may not be available under this plan.

What should I do if I need urgent assistance?

For urgent assistance, you can contact Britam’s customer service directly through their helpline or WhatsApp number (0705100100)

What is Takaful?

Takaful is a mutual insurance concept that operates in accordance with Islamic principles, which are based on fairness, transparency, and social responsibility. It is designed to help people protect themselves against risks and losses, while remaining true to their religious values and principles.

What is Sharia Compliance?

Shariah compliance is the adherence to the Shariah rulings and principles found in the main sources of the Holy Qurán and the Prophetic traditions. The five overriding objectives of Shariah law can be summarized as safeguarding one’s Religion, Selves, Minds, Progeny and Wealth.

Such rulings can either be based on ijtihad, tawil, or qiyas. The bulk of Shariah rulings and principles are firm and intact over time and are unchangeable. However, the status of the compliance can change over time, depending on circumstances at the time of the ruling. This is particularly true of finance, e.g. both banking and insurance.

What makes Takaful Sharia compliant?

The key principles of Shariah compliance in the context of Takaful are:

- The prohibition of gharar, which refers to uncertainty or ambiguity. This means that Takaful is based on a contract of tabarru’ (donation) and not a contract of exchange like conventional insurance. According to Shariah, gharar, can affect contracts of exchange but not contracts of donations such as Takaful. Further, Takaful products must be designed in a way that is transparent, fair, and avoids ambiguity. The terms and conditions of the Takaful contract must be clearly defined, and the risks and benefits of the product must be clearly understood by the policyholder (termed ‘participant’ in Takaful).

- The prohibition of the practice of maysir, or gambling. This means that Takaful is a mechanism of risk sharing (akin to mutual insurance) rather than transferring risk. Participants contribute funds to a common Fund to protect against losses. These contributions are termed tabarru or donations. The takaful Fund is managed on behalf of the participants by a Takaful Operator in exchange for a fee (the wakala or agency fee). Participants of a Takaful scheme are considered co-owners of the Fund and share in the surpluses and deficits of the Fund. This approach encourages members to take an active role in managing risks and helps to create a sense of community and mutual support.

- The prohibition of riba, which refers to interest or usury. This means Takaful operators invest a portion of the Takaful Fund in Shariah-compliant investments only. Takaful Operators cannot invest in interest(riba)-based financial instruments, such as bonds or fixed deposits. Instead, Takaful Operators invest in Shariah-compliant assets, such as equities (of companies that exclusively engage in Shariah-compliant businesses), real estate, and other non-interest-based financial instruments.

- The prohibition of riba also means that if the takaful Fund falls into a deficit the Takaful Operator provides a qard (an interest-free loan), which would be a first charge on any future surpluses arising from the common Fund.

How does Takaful differ from insurance?

Takaful is a system whereby participants share risk by making specific contributions into a Fund that is used to pay for losses suffered by its members. Takaful is premised on mutual co-operation and solidarity, therefore entails risk sharing.

Insurance (other than mutual insurance) involves the transfer of risk from individuals to an insurance company in exchange for a specific premium payment. The insurance company takes on speculative risk wherein it expects that the total premiums it collects would exceed the sum of the expenses it incurs and total claims it pays out. This is akin to the practice of maysir, or gambling, which is forbidden under Shariah law. Takaful is a Shariah-compliant alternative to insurance.

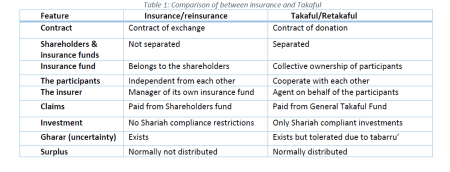

Table 1 compares the key features of insurance and Takaful.

Must surplus be paid to participants in a takaful contract?

Payment of surplus to participants is not mandatory. The decision to pay surplus is based on actuarial assessment of the sustainability of the Takaful Fund. It is made when the total amount of the Fund is sufficient to cover losses in the foreseeable future.

What is ReTakaful?

Retakaful is a Shariah-compliant form of reinsurance. In contrast to reinsurance, where the insurer (to whom the risk has been transferred by the insured) offloads a portion of the risk to the reinsurer, the Takaful pool actively shares risks with the Retakaful pool. This sharing is facilitated through the payment of a contribution from the Takaful pool to the Retakaful pool.

The Retakful Operator takes a wakala fee from this Retakaful contribution in return for managing the Retakaful Fund. The Retakaful Operator meets its expenses of managing the Retakaful Fund from this fee. Similar to the Takaful Operator, the Retakaful Operator is obliged to make a qard payment to the Retakaful pool should a deficit arise. This is subsequently repaid from future surpluses from the Retakaful Fund.

How does index-based livestock Takaful (IBLT) work in practice?

IBLT is designed to prevent the loss of livestock due to drought by providing funds for pastoralists to purchase feed for their livestock when there is inadequate pasture. It is not meant for restocking after livestock loss.

The payout is based on an index that measures the level of pasture in an area. If the pasture available for livestock is too low (i.e. the vegetation index falls below a minimum level of greenness) the contract pays out a sum of money which is enough to keep a unit of livestock alive. The payout is therefore less than the total value of a livestock and is unlikely to cover the cost of replacing a lost livestock, illustrating the preventive intention of this intervention.

What Takaful model does the DRIVE product adopt?

Figure 1 summarizes how the Takaful scheme for pastoralists in Somalia operates based on a hybrid Wakalah and Mudarabah model. Total contributions from the Government and pastoralists are first split between a wakala fee and a tabarru’.

The Takaful Operator uses the wakala fee to cover its own expenses.

The General Takaful Fund pays a retakaful contribution into a General Retakaful Fund, which is to manage the risk of the General Takaful Fund being inadequate to cover all the members’ losses.

A portion of the General Takaful Fund is not used to pay claims but to invest in sharia-compliant investments, which increases the total amount of funds available in the General Takaful Fund to cover members’ losses. The Takaful Operator manages the investment on behalf of the participants. The proceeds from investments are shared equally by the Takaful Operator and the General Takaful Fund.

In the event of a loss by a participant, the Takaful Operator pays using money from the General Takaful Fund as well as from recoveries from the General Retakaful Fund.

If the total amount available in the General Takaful Fund and the General Retakaful Fund is not enough to cover the losses, the Takaful Operator provides an interest-free loan (Qard) to the General Takaful Fund. In the event of an annual surplus, the fund first pays back any outstanding Qard provided by the Takaful Operator, if applicable. Once the Qard is completely paid back, participants may receive a share of the remaining surplus.

Note: The General Takaful Funds in Somalia are not yet being used to pay losses because this is a new product and will require time for the Funds to accumulate sufficient capital and reserves. Takaful funds in Ethiopia cover 10% of the losses and the Retakaful and retrotakaful Funds cover the balance.

What is the status of the Takaful market in Somalia?

The Somalian market is nascent, comprising 6 Takaful Operators and 1 broker, each with two to nine years of existence. There is no Retakaful Operator. Between 2019 and 2022, total contributions increased by over 40% from US$6.5 million to US$9.2 million. However, the bulk is from medical cover for expatriates.

Is the local Takaful market holding the risk under DRIVE?

Given the nascent nature of the Takaful Operators in Somalia, their Takaful Funds are not being used to underwrite the losses (underwriting here refers to a source of qard to cover any excess of claims over contributions). Instead, the losses are being met from the Retakaful Funds of participating Retakaful Operators through ZEP-RE. In time, it is expected that local Takaful Operators will retain a portion of the risks in their respective takaful funds. This temporary arrangement has been considered shariah compliant on an exemption basis by the ZEP-RE sharia advisor.

The ZEP-RE Retakaful Fund in turn is not expected to retain all the risks and thus require (conventional) retrocession support as currently there is no capacity to retrocede to another retakaful fund. Again, this is considered as Shariah compliant by the ZEP-RE Shariah advisor on a temporary dispensation basis.

How is Sharia compliance established in Takaful?

A Takaful Operator establishes a Shariah Supervisory Board (SSB) to provide guidance and oversight to management to ensure that all Takaful operations are in line with the values and principles of Shariah. The SSB is made up of experts in Islamic law and finance.

The SSB is responsible for ensuring that the Takaful Operator manages the operations in an ethical and socially responsible manner. The SSB reviews the full range of operations including:

i. The design, operation, and management of Takaful products and services.

ii. All operations, including investments, contracts, risk management, and governance.

iii. The social and environmental impact of the Takaful Operator’s investments.

Why is there a need for a Supreme Sharia Supervisory Board (SSSB) or National Sharia Council?

In summary, while insurance is not Shariah compliant, Takaful is, based on the opinion of the appointed Shariah scholar. As the interpretation of Shariah law can vary even within a jurisdiction (depending on the teachings and understanding of the subject matter by the Shariah scholar involved) it is vital to have a common understanding of what is considered Shariah compliant and what is not within the regulated jurisdiction This would avoid confusion to the public and allows the regulator to issue takaful regulations that apply consistently across the industry. Thus, there is a need for a Supreme Sharia Supervisory Board (SSSB) at the regulator level whose fatwas (a ruling or point in Islamic law) are generally accepted by those governed by the laws of the country. The SSSB provides guidance and oversight by issuing operating standards and guidelines that ensure that all Takaful operations in the country are in compliance with Shariah principles as interpreted by the SSSB. By following these principles, Takaful operators can provide a socially responsible alternative to conventional insurance, while remaining true to their religious values and principles.